Filling station of the future: Mobility hubs need flexible IT

There is no doubt that the extent and manner in which people get around will change rapidly in the coming years, as will the way in which goods are transported. Filling station operators will have to adapt to this. Depending on their location and function, their stores will change their product range as well as the way they sell and run promotions. Even if forecasts predict that the business with liquid and gaseous fuels will by no means lose its importance, at least until 2040, petrol stations will still have to redefine themselves within the overall mobility network.

It is highly likely that petrol stations will become part of transport hubs in the future, where individual passenger transport as well as car sharing and car pooling systems will be connected to public transport. Compared to the forecourt stores of today, the sale of consumer goods and the catering services at these hubs will gain in importance.

Even if it is not possible to predict exactly where this development will lead, it is safe to assume that the number of services offered in forecourt stores will increase significantly: Just as car washes and lotteries are already handled via the cash tills of petrol stations today, in future the sale of tickets for journeys in modern on-demand shared taxis, the issue of car-sharing vehicles or temporary parking spaces for your own car could create occasions for impulse purchases of consumer goods.

The oil companies, like the food wholesalers that supply them, are aware that the rapid activation of new services requires a high degree of flexibility in the IT systems that control petrol stations. Today and in the future, they want to handle the retail business, fuel sales, e-charging stations and numerous services from a single system. This is not least because they need to operate customer loyalty programmes across all services offered. And therefore need to have a standardised view of their customers and all their transactions in their systems.

Experts who discuss the petrol station of the future agree on one point: the number of services offered there will increase significantly, and the customer journey will become more complex. “Petrol stations will transform into multi-purpose ecosystems, with separate relaxation areas for those who want to read or work, clean and bright areas for eating and even green terraces for socialising,” explains Daniel Monzon, Partner at management consultancy Arthur Little: “Petrol stations will serve as meeting points for different types of consumers, each coming for a different reason.”

With new services and ranges of goods, but also new forms of loyalty activities, petrol station operators can manage to make their service stations increasingly independent of the trade of fuels. Kerstin Meier, Director of Corporate Sales at the wholesaler Lekkerland, which is part of Rewe Group, explains: “Our aim is for customers to come in even if they don’t need to refuel. It’s about making the stores more attractive. People should consciously choose the petrol station to buy tasty snacks, coffee or something else, or to buy wine for dinner.”

The fact that the range of services offered by petrol stations must diversify is also evident for Prof. Hanna Schramm-Klein, the author of the industry studies of the German Association of Independent Petrol Stations (bft): ‘Petrol stations need to reinvent themselves,’ says Hanna Schramm-Klein. In addition to expanding the range of their stores, she sees potential above all in investing in restaurants or leisure facilities. Co-working spaces or quiet zones for travellers are also conceivable to make their stay in the store more pleasant.

The fuel business is here to stay – for the time being

The importance of the fuel business for petrol station operators is already declining relative to the turnover of their convenience stores. But how far will this development go? Will the liquid and gaseous fuels business dry up in the mobility transition? Not at all, say the scientists from the Instituts für Verkehrsforschung des Deutschen Zentrums für Luft- und Raumfahrt (DLR), who were commissioned by the BP mineral oil group to compile the Aral study ‘Filling stations of the future – mobility trends 2040’. They predict that both the number of registered vehicles in Germany and the number of kilometres travelled will rise sharply by 2040.

Even though the 2019 study still anticipates strong economic growth in Germany and working from home was still an exceptional phenomenon at the time – meaning that their forecasts will certainly have to be revised downwards in some areas based on current knowledge – the researchers list a number of factors that will lead to an increase rather than a decrease in traffic on German roads.

The most important factors are the use of autonomous vehicles and the ongoing urbanisation of lifestyles. The former will also enable people without a driving licence to use private transport in the future, while the latter will lead to an increasingly limited supply of local public transport in rural areas. As population density continues to decline, journeys there will also become longer, which, according to the researchers, will lead to a significant increase in the number of kilometres driven. However, it is also conceivable that driverless on-demand shuttles will be used as public transport and therefore the number of privately registered vehicles will increase less.

Autonomous driving still uncertain

However, whether 25 per cent of vehicles will actually be driving autonomously by 2040, as predicted by an older DLR study from 2016, depends on many factors for which no legally secure solution has yet been found: Who is liable in the event of accidents involving autonomous cars? What conditions must be created for the simultaneous use of conventional and driverless vehicles on the same roads?

In the Aral study, DLR predicts that around two thirds of all cars will still be refuelled with petrol in 2040. Although only a few pure combustion engines will be newly registered, older models will still account for a quarter of all cars in use. However, most new vehicles will also fill up with liquid or gaseous fuels, albeit not quite as much overall: as the problem of the very limited range of purely electronically powered vehicles will not be solved by 2040, according to the DLR researchers, most new registrations will be cars with hybrid drive systems.

Hybrid at the petrol station

While many of these hybrid vehicles will draw their power exclusively from their combustion engine and the energy from braking, others will also be rechargeable by cable. For the petrol station of the future, this means that it will definitely have to offer both: Liquid fuels and e-charging stations.

Even if, according to the Aral study, only one per cent of all new cars will be pure combustion vehicles by 2040: Petrol stations with pumps for petrol, diesel or new liquid fuels will not disappear, according to DLR forecasts. And this will not happen so quickly after 2040 either, because even then, new vehicles will predominantly be delivered with a combustion engine as hybrid models.

The number of purely electric cars without a combustion engine will also rise sharply, but according to the researchers, they will mostly be purchased as a second car for shorter journeys, while families who can afford it and who do not live in large cities will buy a car with a hybrid drive as their first car. Electric cars without a combustion engine will mainly be used for journeys to work and for shopping. Their owners will charge them at home, in front of retail stores and at their workplace – the infrastructure for this is already being created today.

According to the DLR researchers, the trend towards hybrid drives will have an even greater impact on commercial vehicles. Pure electric drives will remain in the minority for vehicles weighing 3.5 tonnes or more at least until 2040 – the researchers predict that they will account for 13 per cent of all registered commercial vehicles. As the scientists were optimistic about Germany’s economic performance at the time of the 2019 study, they predict a rapid increase in the number of kilometres driven by commercial vehicles in the country despite a significant decline in the population. But even if they are not right: Lorries will still need filling stations everywhere in the future where they can fill up with liquid fuels, supplemented in some cases by recharging batteries in the same vehicle.

In the road transport segment, gas-powered engines will continue to gain in importance and, according to the scientists’ forecasts, will reach a market share of five per cent of vehicles by 2040. Drives that use methane in liquefied form as LNG as well as those that use it in compressed gaseous form as CNG will continue to be used. If other European countries also ensure the supply of LNG and CNG, the number of lorries powered by gas could increase even further.

Sharing, pooling and park & ride

According to the researchers of DLR, not only will the number of private cars increase by 2040, but also the number of cars used in car-sharing systems. Around 14 per cent of all kilometres travelled will be driven in car-sharing vehicles by 2040. Various forms of car pooling, in which several passengers share a vehicle for a certain route, would account for a further 12 per cent of all kilometres driven.

With the sharp rise in the use of car-sharing and car-pooling systems and increasing on-demand public transport, the importance of connecting public transport such as rail to these systems is also growing. If people will be travelling longer distances by train in the future, switching to car-sharing or car-pooling systems for the last few miles at train stops will have to become more convenient.

Mobility hubs are the future

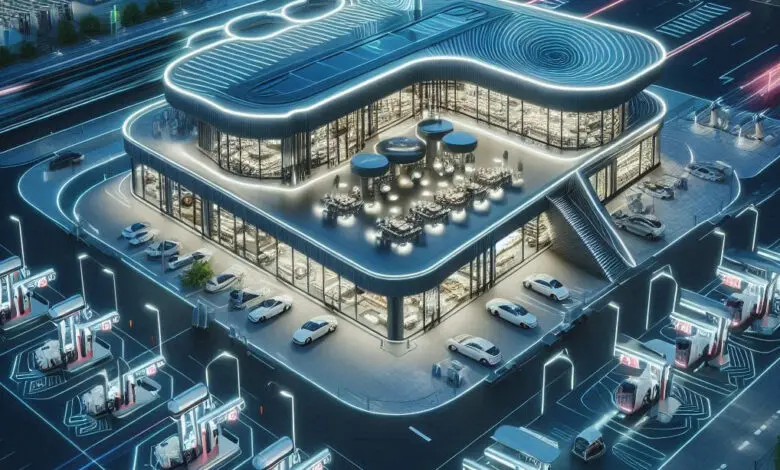

As there will still be a demand for conventional fuels in 2040, many vehicles will also be charged at central locations where they are made available for use as car-sharing or car-pooling vehicles, for hire or as driverless taxis, the petrol station will gain rather than lose significance in society. Car service stations will be replaced by mobility hubs, which will often also link public with private transport. People waiting for passengers will want to have a coffee, a snack or do a little shopping.

Petrol stations are transforming into mobility centres: places with high customer frequency that bundle various mobility services, supplemented by offers and information on all aspects of mobility and energy. These hubs have the potential to drive forward the electrification of urban mobility – and at the same time reduce congestion on the last mile caused by the transport of goods and people.

Many more services, a wider range of goods

German Zukunftsinstitut also assumes in its study on the petrol station of the future, at least in one of four scenarios, that the petrol stations of today will become mobility centres: These are “places with high customer frequency that bundle various mobility offers, supplemented by offers and information on all aspects of mobility and energy. These hubs have the potential to drive forward the electrification of urban mobility,” reads the study by Zukunftsinstitut.

But which new services do the Frankfurt researchers see these mobility hubs of the future offering? The hubs will offer opportunities to swap batteries (for mopeds and scooters, perhaps even for cars) and access to sharing, rental and subscription models, ideally combined with public transport and/or long-distance travel options, they say: “At the same time, the hubs are a snack bar and information centre and also differentiate themselves depending on the neighbourhood and clientele. Charging infrastructure is only available here for shared vehicles that can set off again from this point. Private charging, on the other hand, is handled by charging points in public spaces or at home.”

New services need flexible IT

The two major studies by Aral and the Zukunftsinstitut agree that privately owned electric vehicles are predominantly used for short journeys and are charged at homes and workplaces as well as in retail car parks while shopping. E-charging points at mobility hubs will then play a key role for vehicles in car sharing and car pooling systems. Fully charged, they will be available whenever they are needed. And vehicle washing, which is already an integral part of the forecourt store portfolio, will become even more important as fleet vehicles are cleaned more frequently.

Consequently, the IT systems of petrol station operators will have to be considerably more flexible in the future. This is also because the additional services that the filling stations that have mutated into mobility hubs will offer will vary greatly depending on their location. In particular, the question of the extent to which a location can be connected to public transport – in other words the petrol station will merge with the train station – will play a major role.

Jet relies on GK

Jet has chosen GK as software partner for its petrol stations. The oil company aims to leverage GK's flexibility and 30 years retail experience to be ready for the challenges of transformations in the petrol station sector. The Jet stations are to be transformed into comprehensive mobility hubs where the changing needs of mobile people can be reliably and effortlessly met in the future.

“With ever-increasing changes in the mobility sector, filling stations will not be a mere pit stop in the future, but rather a centre where people expect a broader range of retail services. To cater to these changing demands, we are working with GK, a proven industry expert in retail technology," says Georg Ober, CEO of Jet Tankstellen Deutschland.

Merger with the railway station

Whereas in major cities there will still usually be a lack of space near railway stations in the future, it is highly likely that new developments will be approached in such a way that park, share and ride concepts will be planned around an S-Bahn station, for example. These hubs could become the ideal locations for food retailers – ideally with round-the-clock services, as previously only known in manned form from petrol stations.

The researchers behind the Aral study and those of Zukunftsinstitut agree that the importance of food services for on-the-go consumption will increase at the petrol station of the future. This is hardly surprising when you consider that petrol stations could merge with regional train stations going forward. Today’s petrol station operators will have to put their IT systems to the test in order to do justice to the special features of the various forms of out-of-home consumption, even beyond the services that service station operators are already familiar with today.

Loyalty takes on a completely new role

Up to now, the success of a location in the petrol station business has been determined primarily by its location and its competitive environment. With the diversification of customers’ motivation to visit the mobility hubs of the future, the need for their operators to weave well thought-out customer loyalty programmes into their various goods and service offerings is also increasing. The whole topic of loyalty will take on a completely new status for petrol station operators and their main motivation will be to introduce new merchandise management, store and customer loyalty systems that enable cunsumers to be consistently addressed and retained across all highly diverse product and service offerings.