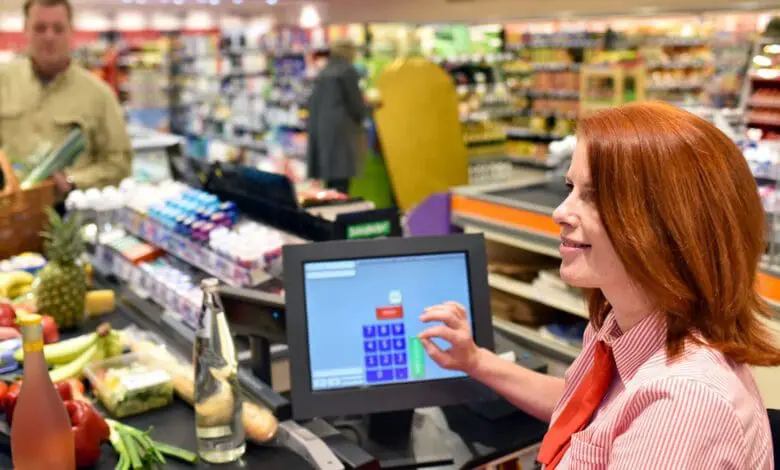

Federal chaos over POS system retrofitting in Germany

Although the retail industry in Germany has enough problems with the temporary reduction of sales tax, the Federal Ministry of Finance is refusing to extend the first deadline for the difficult conversion of the cash register system to tamper-proof security against tax fraud. Against the will of five federal states, which are now extending the deadline at least in exceptions.

Assertions by the German government that it wants to ease the burden on the retail sector because of the lockdown are becoming increasingly implausible. Although the federal states of Hesse, Bavaria, North Rhine-Westphalia, Hamburg and Lower Saxony want to give retailers and restaurants more time to convert their cash registers to VAT fraud-proof (“fiscalisation”), the Federal Ministry of Finance is refusing to grant such an extension.

The five federal states will now give companies until 31 March 2021, at least in exceptions. “I would like us not to demand even more of those affected in these difficult times,” explains Michael Boddenberg, Minister of Finance for the State of Hesse, commenting on this: “Restrictions on contact have meant that in recent months it has not always been possible to install the technical security devices in the cash register on site.”

If other federal states do not follow suit, all nationwide represented retail companies will have to convert their cash registers by the end of September.

The refusal to extend the deadline is particularly annoying because the authorities have not yet certified the cloud-based solutions preferred by retailers, which make it unnecessary to change the hardware at the checkout.

On 1 April, the GK Software subsidiary Deutsche Fiskal has transferred the first cloud solution against tax fraud in Germany to productive operation. This solution is now in the certification process.