Chinese challengers enter the POS hardware market

The global market for POS hardware is growing again after a slump in 2020. British market research company RBR reports that in 2021 manufacturers of electronic cash registers shipped 18 percent more systems than in the previous year. Sales had shrunk by 20 percent at the time.

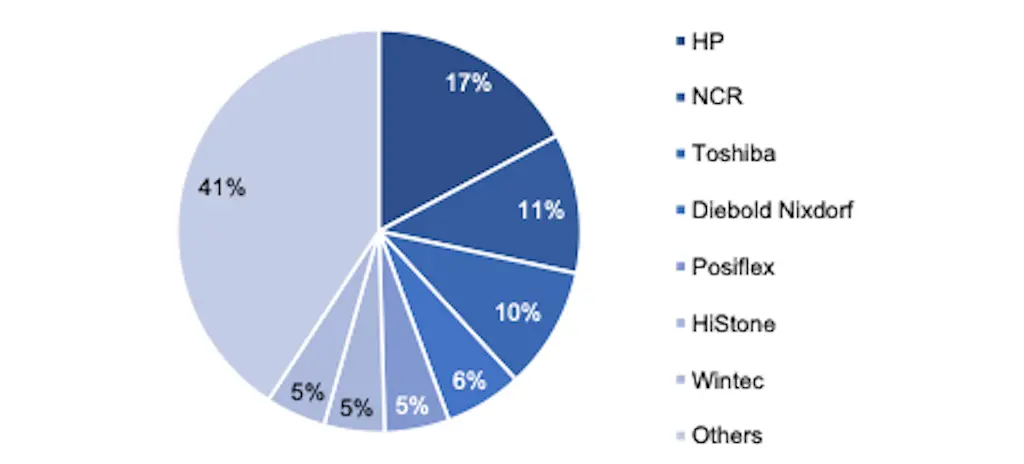

Overall, the industry was able to sell more than two million cash registers last year. This was achieved despite continuing problems in the supply chain and global bottlenecks in chip production. With a share of 17 percent, HP remains market leader, followed by NCR and Toshiba.

However, established suppliers must face a growing number of challengers. Especially manufacturers from China, such as HiStone and Wintec, and from Taiwan like Posiflex are increasingly gaining market shares also in Europe. The Retail Optimiser already reported on this phenomenon in an article on self-checkouts. One reason for this success is certainly the proximity of Asian manufacturers to the procurement markets and associated cost advantages.

Growing opportunities for new suppliers

The global market für POS hardware is highly fragmented. Only two suppliers achieve more than 10 per cent market share. The rest of the pie is shared by hundreds of manufacturers, pure hardware specialists as well as those offering hardware and software as a whole solution.

Thanks to increasing standardisation, the barriers to entry for start-ups and new providers have steadily decreased. Therefore, it is to be expected that more challengers will enter the market. Above all, providers of innovative solutions that can deliver competitive advantages to offline retailers and better dovetailing with online channels have good prospects of prevailing. Fierce competition between POS hardware providers will continue in future. This battle will increasingly be won by best ideas, not only by price.