Diebold Nixdorf surpasses Toshiba in the global self-checkout market

Self-checkout technology continues to grow in the retail sector. According to the latest report from RBR Data Services, now part of Datos Insights, more than 217,000 self-checkout devices were delivered worldwide last year. This is 17,000 more terminals than the year before.

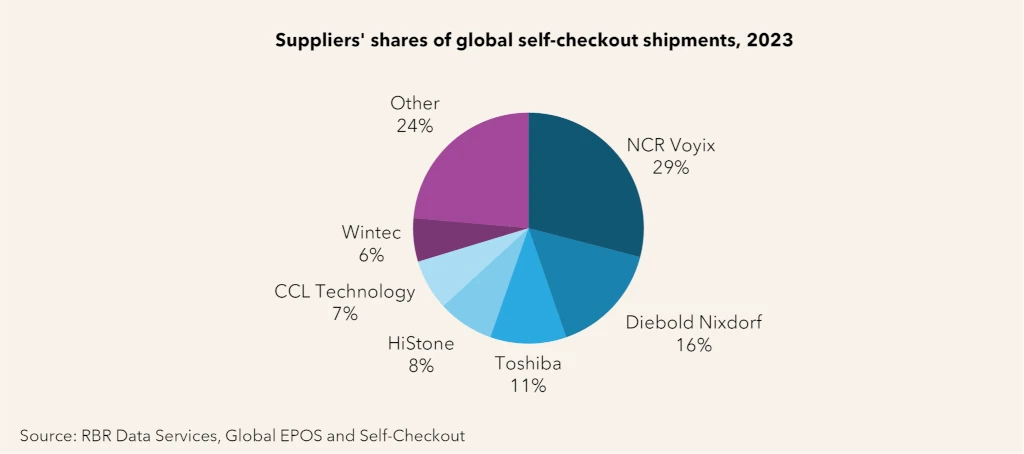

As in previous years, NCR Voyix remains the largest supplier on the market, accounting for just under a third of deliveries. However, according to RBR Data Services, NCR Voyix’s market share has fallen by 4 percentage points since last year. Diebold Nixdorf, on the other hand, has increased its market share by 5 percentage points, overtaking Toshiba and replacing it as second largest supplier on the market.

Diebold Nixdorf has been able to convince major retailers such as Aldi Süd and the drugstore operator Rossmann of its solutions. After an extensive test phase, the discount giant Aldi Süd has opted for Diebold Nixdorf’s terminals, as reported by The Retail Optimiser. Starting in 2021, Aldi Süd tested the self-checkouts in individual German stores and, most recently, in 30 stores. Aldi Süd is now rolling out the devices in its outlets from Australia to the USA.

Relevant market shares for 4POS and Dutch Pan Oston

Swiss provider 4POS has also secured itself an important place in the global market of SCO suppliers with major German retailers, who are now introducing self-checkouts on a large scale for the first time. The largest banner operation in the European retail sector, Schwarz Group’s discounter Lidl as well as Rewe Group are among 4POS’ customers. Although RBR only provides details of its study to its paying customers, 4POS itself has reported to The Retail Optimiser that it supplied 7,525 self-checkouts in 2023 in the food retail sector alone, which would correspond to a market share of 3.5 per cent.

In addition, the market share of Dutch Pan Oston, a sister company of 4POS, is also growing significantly. Among many others, the drugstore operator dm relies on Pan Oston (as reported by The Retail Optimiser) and the majority of Dutch grocery retailers also use Pan Oston’s solutions.

Chinese suppliers remain in their domestic market

The market shares of the Chinese suppliers HiStone, CCL Technology and Wintec remain almost unchanged from last year. They account for one fifth of deliveries. HiStone is the market leader in its home market, followed by CCL Technology, which increased its market share by 2 per cent.

In total, RBR Data Services counts around 50 providers, ranging from international companies to local players, as well as solutions that retailers have built themselves.